Startup funding can be quite a important factor for business people in Australia wanting to transform their modern Tips into feasible businesses. That has a assortment of funding sources out there, from federal govt grants to non-public investment decision, Australian startups get use of major means that will help them get over monetary boundaries and fuel development.

Kinds of Startup Funding in Australia

Governing administration Grants and Packages: The Australian government presents numerous grants and incentives designed for startups. One particular through the most favored would be the Investigate and Advancement (R&D) Tax Incentive, which materials tax offsets to providers buying suitable R&D functions. A further notable system would be the Business people' Programme, that provides funding and pro advice to assist you to startups develop their competitiveness and efficiency.

The New Company Incentive Plan (NEIS) is another important initiative delivering you with coaching, mentoring, and income guidance to suitable folks beginning a refreshing organization. This is particularly therapeutic for business owners who require foundational assistance to make their ventures from scratch.

Enterprise Money (VC): Undertaking capital is actually a big way to get funding for Australian startups, Primarily People in technological innovation and innovation sectors. VC companies provide budgets to amass equity, frequently centering on superior-advancement prospective corporations. Notable VC corporations in Australia include things like Blackbird Ventures, Square Peg Cash, and Airtree Ventures. These firms typically obtain early-stage startups, offering not basically capital but will also useful company knowledge, connections, and mentorship.

Angel Traders: Angel traders are individuals who supply early-stage funding to startups, usually in exchange for fairness. These investors frequently here seek for significant-possibility, substantial-reward chances and should be viewed as a useful technique to get cash for startups which could not even be eligible for the money boosting or financial institution loans. Angel buyers in Australia, like Sydney Angels and Melbourne Angels, Moreover give mentorship and steerage.

Crowdfunding: Crowdfunding has emerged as a preferred process for startups to boost funds in Australia. Platforms like Pozible, Kickstarter, and Indiegogo allow business owners to pitch their tricks to the public and gather small contributions from a good number of backers. This method is quite captivating for Artistic, social, or community-pushed jobs.

Accelerators and Incubators: A lot of Australian startups gain from accelerator and incubator packages. These programs, such as Startmate and BlueChilli, provide funding, mentorship, and assets in exchange for equity. They are intended to rapidly-keep track of the introduction of startups, supplying intense help around the small interval.

Difficulties and Concerns

While there are several funding options out there, rivals are intense. Securing startup funding often works by using a strong business strategy prepare, crystal clear financial projections, in addition to a powerful pitch that demonstrates the viability and scalability through the concept. In addition, business people must be mindful Using the conditions connected to Every funding resource, such as fairness dilution with VC or angel investments.

Conclusion

Startup funding in Australia is numerous, offering combining authorities assist, private investment decision, and several approaches like crowdfunding. With the proper method and preparing, entrepreneurs can make use of these methods to gasoline their business growth, speed up innovation, and create a strong market presence. Regardless of whether it’s by means of grants, expansion capital, or angel buyers, Australian startups gain use of A variety of alternatives to turn their Concepts into effective corporations.

Jake Lloyd Then & Now!

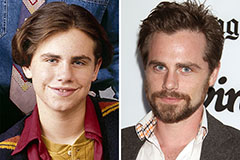

Jake Lloyd Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!